We’re thrilled to announce the return of GamesBeat Subsequent, hosted in San Francisco this October, the place we are going to discover the theme of “Taking part in the Edge.” Apply to converse right here and be taught extra about sponsorship alternatives right here. On the occasion, we can even announce 25 prime recreation startups because the 2024 Sport Changers. Apply or nominate as we speak!

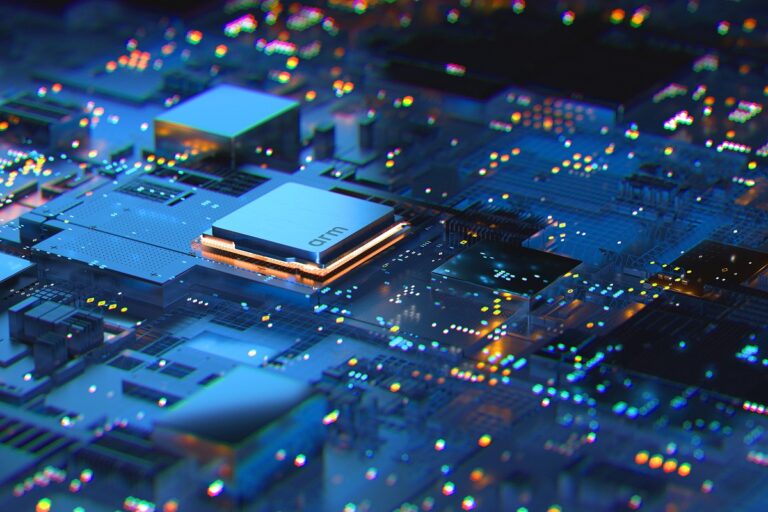

Arm Holdings, the chip structure agency owned by SoftBank Group, is poised to raise about $4.7 billion in its preliminary public providing that valued the corporate at greater than $54.5 billion.

Reuters reported earlier that the IPO was oversubscribed by six instances. As such, the corporate is in a place to break the ice in the IPO market, with hopes that a rally may open the window for different firms to do the identical. But Masayoshi Son, CEO of SoftBank, reportedly determined the $51 a share worth for the 95.5 million shares going up on the market on Thursday was prudent.

SoftBank itself had hoped for the next valuation, as final month SoftBank acquired the 25% share of Arm that it didn’t personal in the corporate at a $64 billion valuation.

Cambridge, United Kingdom-based Arm selected to go public in the U.S., creating demand for the biggest IPO in U.S. in the previous two years. The corporate has a 99% market share in cellphones, and it has made incursions into markets reminiscent of processors for PCs and servers. Arm’s gadgets are all the time vitality environment friendly, as the corporate’s structure is a descendant of RISC computing, which centered on vitality effectivity whereas Intel’s rival structure centered extra on efficiency.

Occasion

VB Remodel 2023 On-Demand

Did you miss a session from VB Remodel 2023? Register to entry the on-demand library for all of our featured classes.

However the weak international market has damage gross sales. Total gross sales totaled $2.68 billion in the 12 months ending March 31, in contrast to $2.7 billion in the yr precedent days. Arm has tried to compensate by shifting aggressively into the automotive chip market and different areas as nicely.

The significance of semiconductor chips

Chips are the inspiration of the trendy electronics business. They’re the thumbnail-sized slivers of silicon that, when processed, have billions of elements often known as transistors on their surfaces. They’re laid out in circuitry that can be extra advanced than a road map of the globe. A typical semiconductor processor today has extra transistors than 16 instances the variety of individuals on Earth.

Again in 1971, Intel’s first microprocessor had 2,300 transistors. In the present day, the newest Arm-based Apple Watch has 5.9 billion transistors. The reason being the compounding impact of Moore’s Regulation, the prediction made in 1965 by Intel’s former CEO Gordon Moore, that held that the variety of transistors on a chip would double each couple of years.

With such enhancements in effectivity, our digital items have gotten higher each couple of years. They turn into sooner, cheaper smaller, enabling smaller and smaller digital gadgets. Moore’s Regulation has slowed down currently, however the advances are nonetheless coming quick. Apple’s newest M2 Extremely processor for its Macs has 134 billion transistors.

The business hit $574 billion in 2022, a yr when the scarcity of such chips crippled many industries that have been whipsawed by the demand modifications throughout the pandemic. A scarcity of chips in 2022 idled Ford’s factories for a lot of weeks of the yr, as there weren’t sufficient chips to put in the completed vehicles. It’s additionally why recreation consoles have been in such quick provide years into the cycle of the Xbox Sequence X/S and PlaySTation 5. Shortages like this did untold harm to the world economic system.

Chips have been such a strategic business that Congress accredited the CHIPS and Science Act in 2022, authorizing $280 billion in new funding to enhance home analysis and manufacturing of semiconductor chips in the US. And Arm is likely one of the firms that designs the framework — dubbed structure — for processors that are the brains of the digital gear.

Competitors

Intel and Superior Micro Gadgets are rivals with a deal with x86 structure, mostly used in PCs, servers and recreation consoles.

MIPS can also be a rival, and Arm additionally faces competitors from an upstart know-how, RISC-V, that is being supplied as an open-source various with no royalties. It was created by a gaggle of teachers who have been mortified at the charges that Arm was charging even for analysis functions.

Jack Kang, senior vice chairman at RISC-V chip design agency SiFive, congratulated the rival Arm for its IPO, which he mentioned “represents a momentous step ahead for the complete semiconductor ecosystem.”

He mentioned in an announcement, “This IPO has introduced extra consciousness to the general public concerning the essential function of computing architectures, particularly the instruction set structure (ISA), and the necessity for high-quality, high-performance processor IP to drive our business ahead.”

Kang famous competitors is crucial for a wholesome semiconductor business, and a part of the thrill has been a brand new recognition of how massive the market alternatives are.

“And there may be room for all of us. These markets want fast innovation and customization, that are constant themes in our conversations with clients. It’s no secret that SiFive’s founders developed RISC-V as a response to the restricted customization choices of closed, proprietary architectures,” Kang mentioned.

Arm by the numbers

Arm has 5,963 staff from greater than 85 nations. About 80% of them on centered on analysis, design and technical innovation. The corporate’s engineers invested 10 million hours creating the bottom software program and instruments for chips with Armv8 processors. And Arm spent 30 million hours creating the bottom software program and instruments for Armv9 processors.

Arm mentioned that in 2023, the overall addressable marketplace for its chips is $200 billion in chip worth, and that may develop to $250 billion by 2025.

Moreover smartphones, Arm is chasing after AI, automotive, laptop infrastructure, the web of issues, and chips embedded in home equipment and different gadgets.

Arm mentioned it has greater than 1,000 ecosystem companions, which means the licensees and different supporters who make chips based mostly on Arm’s architectural designs. It’s like Arm designs the framework for a automotive, after which the chip design and manufacturing companies create particular person automotive fashions based mostly on the general construction of getting an engine and 4 wheels.

However Arm additionally wants to listen to geopolitical points. The U.S. and China have a frosty relationship, and each side are racing to safe chip provide chains. China accounted for 24.5% of Arm’s income in the final fiscal yr.

Japan-based SoftBank will nonetheless personal greater than 90% of Arm in the wake of the IPO. Nvidia tried to purchase Arm for at least $40 billion, however regulators put a cease to that deal. To shore up its shareholder assist, Arm enlisted many consumers as cornerstone traders in its IPO, together with Apple, Nvidia, Alphabet, Superior Micro Gadgets, Intel and Samsung Electronics.

GamesBeat’s creed when overlaying the sport business is “the place ardour meets enterprise.” What does this imply? We wish to inform you how the information issues to you — not simply as a decision-maker at a recreation studio, but in addition as a fan of video games. Whether or not you learn our articles, hear to our podcasts, or watch our movies, GamesBeat will show you how to be taught concerning the business and revel in partaking with it. Uncover our Briefings.